Weekly protein digest: China's meat imports expected to fall in 2021

Jim Wyckoff's latest beef and dairy industry updates track China's import future and the international dairy market.Beef industry news from China

Chinese meat imports remain strong this fall

China imported 834,000 metric tonnes (MT) of meat during September, a slight increase from August, according to preliminary customs data. So far this year, China has imported 7.41 MMT of meat, a 72 percent surge from year-ago.

Beef imports likely totalled 180,000 MT in September, pushing the nine-month tally to 1.57 MMT, a 38.8 percent jump for the year.

China seen pulling back on meat imports in 2021

USDA this week reported global meat imports will decline marginally in 2021 as softening demand from China offsets gains elsewhere. China meat imports are forecast to set records in 2020 due to a sharp decline in pork production from African swine fever (ASF). Next year, imports are expected to fall as producers rebuild swine herds and production rebounds. Outside of China, global meat imports are largely rebounding as economies bounce back from COVID-19 and as food service demand improves.

China beef imports are forecast 4 percent higher at 2.9 million tons in 2021– another record high. Evolving tastes and relatively modest production growth are expected to support beef imports next year. However, rebounding pork production will slow growth in beef imports to the slowest pace in more than 5 years.

USDA issues annual China feed use report

China’s 2020/21 feed and residual use for all coarse grains and feed-quality wheat are estimated to increase 3.2 percent compared to the previous marketing year due to a projected recovery of swine production and strong expansion in the poultry and ruminant sectors.

Though typhoons caused heavy damage and extensive lodging in the major corn producing north-eastern provinces, the impact on overall production will be limited as storms hit only weeks before harvest and will not result in a total loss.

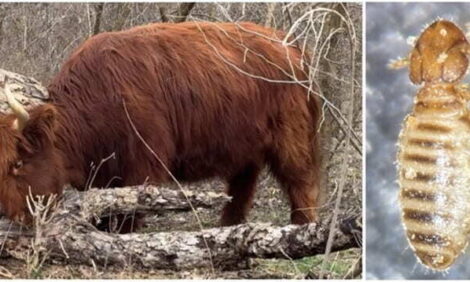

In addition, Fall army worm (FAW) impact is less than anticipated resulting in a total decrease in corn production of only 4 percent. While China may rely more on corn imports in the coming marketing year, some of these gains will be mitigated by an increased use of sorghum, barley, and old rice and wheat stocks in feed rations to take the place of record high-priced corn.

Weekly USDA milk report

Weekly fluid milk

Seasonal fall weather, with cooler temperatures, is common over most of the United States and in turn supports a steady to high trend in farm level milk output. In the Central region, the southern portion of the region milk shows yields are higher. In the East, Florida’s output is picking up, while farm milk is steady in the Northeast. Western milk production is generally stable throughout the region, with slightly higher volumes in New Mexico. Handlers report there are few movements of milk across the state line into Arizona.

Class I bottling demand has increased as more schools open their doors. Cream markets are active as Class II and Class III increase their demand for available supplies. Contracts are being negotiated for next year. FOB cream multiples for all Classes are 1.30-1.42 in the East; 1.24-1.38 in the Midwest; and 1.05-1.26 in the West.

Dry products

The low/medium heat non-fat dry milk market is steady to higher in the range across regions. The market has been willing to follow the market higher for immediate availability. Mexico interest is steady to lighter.

Dry buttermilk prices are steady to higher in the Central and East, while steady in the West. Demand is improving at seasonal rates, with active churning supporting dry buttermilk availability. Dry whole milk prices are mixed this week.

Demand from bakery and confectionery sectors is good. Production is sporadic. Dry whey prices are higher in the West and Northeast, but mixed in the Central region. Demand is stable as sales improve. Production is active. The whey protein concentrate 34 percent prices are higher.

Buyer spot interest rose this week. Production is steady to lower. Lactose prices are unchanged. Production is steady as stocks increase. Rennet casein prices are lower. Acid casein prices are steady.

International dairy market news

Western Europe overview

Autumn weather in Western Europe has been favourable to milk production. Most of the primary producing countries have reported year on year increases in recent weeks.

While an annual increase is expected for 2020, some dairy experts in Western Europe caution that the pace of recent YOY increases folded into full 2020 data may effectively slow in the final three months of 2020 because in 2019, it was the final quarter where growth really broke through and lifted the annual data.

Milk production is seasonally declining. Germany is heading toward the seasonal low in November. A similar pattern is noted in France.

Eastern Europe overview

In Poland January – August 2020 milk production was reported as 4.7 percent higher than January – August 2019 according to CLAL data provided to USDA. Production of some dairy commodities in Poland January – August 2020 compared with January – August 2019, are cheese, +4.0 percent; butter, +8.9 percent; and SMP, +5.8 percent.

US milk retail report

This week, the total number of conventional ads decreased 6 percent, and organic ads decreased 4 percent.

Conventional ice cream in 48-64 oz containers is the most advertised dairy item. The weighted average price for conventional 48 to 64-ounce ice cream packages is $3.38, up 21 cents from last week.

Ads for conventional 1-pound butter increased 27 percent, with a weighted average advertised price of $3.26, up 26 cents from last week.

The total number of conventional cheese ads decreased 11 percent. The weighted average price for 8-ounce conventional cheese shreds was $2.35, up 2 cents from last week. There are no organic cheese ads this week.

The national weighted average advertised price for conventional milk in half gallons is $2.41, compared to $4.31 for organic milk half gallons. This results in an organic premium of $1.90.

The total number of conventional milk ads increased 41 percent. Organic milk ad numbers increased 31 percent.

August dairy products highlights

Butter production was 152 million pounds, 7.8 percent above August 2019, but 1.6 percent below July 2020.

American type cheese production totalled 446 million pounds, 1.3 percent below August 2019, and 1.9 percent below July 2020. Total cheese output (excluding cottage cheese) was 1.09 billion pounds, 2.1 percent below August 2019, and 1.6 percent below July 2020.

Non-fat dry milk production, for human food, totalled 144 million pounds, 8.8 percent above August 2019, but 11.7 percent below July 2020.

Dry whey production, for human food, was 79 million pounds, 5.8 percent below August 2019, and 4.8 percent below July 2020.

Ice cream, regular hard production, totalled 69.1 million gallons, 7.6 percent above August 2019, but 3.5 percent below July 2020.

Read Jim Wyckoff's updates on the global poultry industry on The Poultry Site and see his Weekly pig outlook on The Pig Site.

TheCattleSite News Desk

IMPORTANT NOTE: I am not a futures broker and do not manage any trading accounts other than my own personal account. It is my goal to point out to you potential trading opportunities. However, it is up to you to: (1) decide when and if you want to initiate any traders and (2) determine the size of any trades you may initiate. Any trades I discuss are hypothetical in nature.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading (and I agree 100%): 1. Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND RISKY BUSINESS. Before you invest any money in futures or options contracts, you should consider your financial experience, goals and financial resources, and know how much you can afford to lose above and beyond your initial payment to a broker. You should understand commodity futures and options contracts and your obligations in entering into those contracts. You should understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk disclosure documents your broker is required to give you.