Argentina Looks to Export Markets for Dairy Products

Argentina’s dairy farmers annually deliver about 30 per cent more milk than required to meet domestic demand. Its processing sector has had moderate success in export markets.Yet a combination of factors including restrictive government

policies, weather dependence, competition for

resources from other ag sectors like beef, sheep and

soybeans, and healthy growth in domestic consumption—

limited dairy industry growth and kept the nation

off most prognosticators’ lists of up-and-coming

exporters - until now.

Argentina’s dairy performance over the past year-plus,

shifts in government policies and an influx of investment

suggest the nation may be more of an export force in

the years ahead than many imagined.

Farm conditions—everything from weather to farmgate

milk prices to milk profitability vs. other ag sectors—were

ideal, driving milk output 13 per cent to nearly 12 million

tons last year, according to statistics from Argentina’s

Ministry of Agriculture, Livestock and Fisheries.

It was

the fourth straight year of rising output. In the first five

months of 2012, production grew more than nine per cent.

At the same time, the government eased dairy export

restrictions that were implemented mid decade to keep

a lid on domestic retail dairy prices.

Argentine exporters also benefit from market access

provisions in the country’s existing regional trade agreements,

such as Mercosur and Unasur.

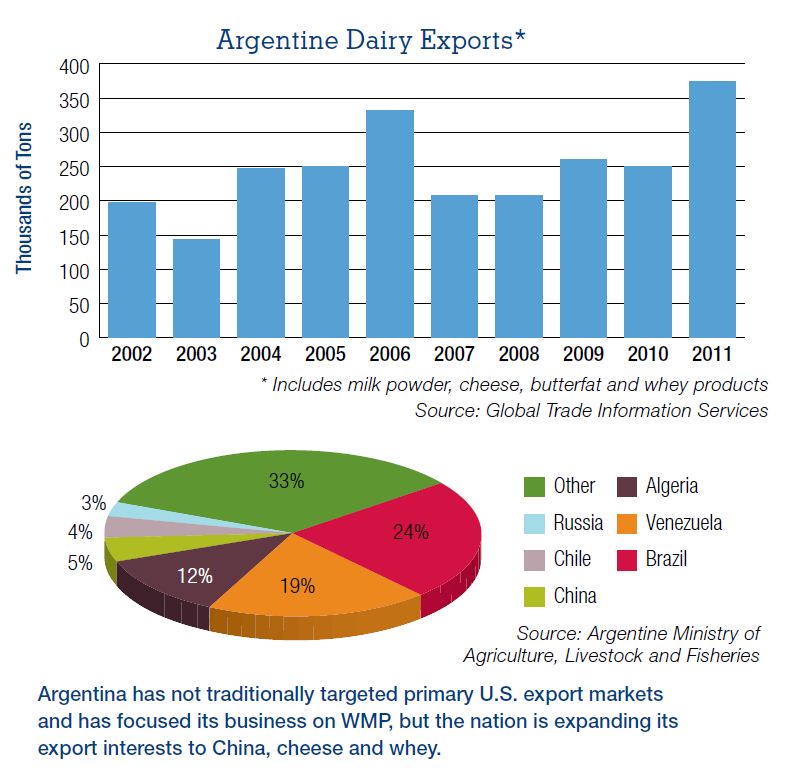

The government reported Argentine dairy export

volume rose 39 per cent to 440,083 tons in 2011, led by

milk powder (mostly WMP, up 54 per cent to just under

200,000 tons). Cheese (+33 per cent) and whey and its

derivatives (+55 per cent) also showed healthy gains.

Looking ahead

Some of the nation’s largest dairy processors appear

to think more good days are to come. La Serenissima,

NAM Corp., SanCor and others have recently made or

announced major investments, largely geared toward

expanding drying capacity for milk and whey.

The country is also looking to broaden its customer

base beyond Algeria and Latin America. Recently, the

Dairy Industry Center, for example, took a group of

cheese producers to China to lay the groundwork to

increase cheese exports.

“The factors often cited as limiting milk production and

dairy export growth proved inconsequential over the

past year or two,” says Sonia Amadeo, USDEC’s South

American office representative.

“But whether Argentina

can maintain its dairy industry growth is unknown.”

Industry constraints have subsided but not disappeared.

Farmgate prices that are declining around the

world will likely catch up to Argentine producers. Other

ag crops could cycle back to the top of the profitability

heap.

Plus, the Argentine government is infamous for keeping

a tight rein on trade and could re-implement dairy

export restrictions at any time. To top it off, the nation’s

top dairy buyer, Brazil, is keen on limiting Argentine

dairy flows to protect its own domestic industry.

Ms Amadeo says: “The question is whether the country

can sustain growth, keep investing in capacity and

prevent backsliding if conditions deteriorate.”