Cheddar Markets Review - Cheese Production Waiting on Milk Price Queues?

Wholesale cheddar has kept price static recently which has allowed value to be passed down to producers, concludes DairyCo in their second installment of their cheddar market analysis.However, DairyCo says that if UK cheddar output is to rise, long term improvements need to be seen in farmgate prices.

Dairy commodity Review - 2012/13

To understand market movements in 2012/13, it’s important to look back to the previous year. Near perfect milk production conditions across the world in the second half of 2011/12 saw global milk supply exceeding demand.

This led to a glut in tradable dairy products early in the 2012/13 year. As can be seen in Figure 1, global commodity markets fell sharply as a result, with butter and cream prices particularly affected.

EU Private Storage Aid butter stocks reached 90,000 tonnes, levels not seen since 2009. Butter stocks in the USA were also 38 per cent higher than in the previous year2. However, this supply-driven market volatility did not become as extreme as that witnessed in the 2009 trough following the global financial crisis in 2008, when global demand faltered.

By mid-2012, trader confidence had returned to the market place and global dairy markets started to rebalance. Prices returned to an upward trajectory from June 2012 as milk supplies began to tighten and tradable stocks reduced. The continuation of extreme wet and cold weather conditions in Europe and drought in the USA brought about a sharp rebalancing of global milk supplies by the end of 2012.

Less-than-ideal milk production conditions in the southern hemisphere from November to February in 2012/13 further tightened supplies. This resulted in less milk going into powder production, despite demand from emerging economies remaining resilient. By April 2013, world whole milk powder (WMP) and skim milk powder (SMP) prices had hit record levels averaging $4,790/tonne and $4,304/tonne respectively.

The surplus milk supplies in the first half of 2012 also led to an increase in world cheese production. Although Cheddar stocks increased in 2012/13 as a result, wholesale Cheddar prices remained more resilient to the mid-2012 downturn. With plenty of global stocks available to meet demand, Cheddar prices did not spike to the extent of powders in the first half of 2013. However, with global commodities in general remaining tight, despite softer demand growth from emerging countries, there is likely to remain support for current price levels throughout 2013.

Conclusions

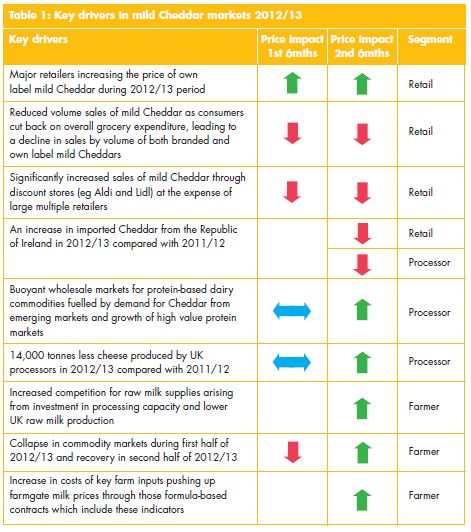

The 2012/13 Cheddar Supply Chain Margins report highlights considerable challenges faced by farmers, processors and retailers over the past three years. Farmgate prices have been under upward pressure as farmers absorb increased production costs, together with the effects of adverse weather conditions leading to tight milk supplies in the UK.

With wholesale markets for Cheddar remaining well balanced and relatively price-static over the past two years, processors have been unable to pass on increases in farmgate prices to retailers. Using the Defra average farmgate price, this has reduced processor margins in relative terms to under 3ppl on private label mild Cheddar.

This leaves little room for processors to absorb any further rises in average farmgate prices without corresponding increases to wholesale prices. Retailers have seen Cheddar sales volumes reduce as consumer household budgets continue to be squeezed. While branded Cheddar remains an important part of the value gain at retailer level, there has been a move towards budget varieties as well as an overall shift in grocery sales through discount stores. In this environment, retailers have significantly increased the retail price of Cheddar, possibly to appear to offer more on discount.

The net effect has enabled retailers to increase mild Cheddar prices by 5 per cent while stabilising mature Cheddar prices. Retailers continue to retain just under half of the retail selling price of private label mild and mature Cheddar. Looking into the future, Cheddar production could continue to be constrained as competition for raw milk supplies remains throughout 2013. In the wider EU, where around 60 per cent of milk produced is destined for cheese, a tight milk supply situation is expected to see less milk channelled into commodities such as powders and butter in 2013/14, in order to maintain cheese production at around 2012/13 levels.

However, in the UK, where liquid milk dominates the dairy market sector, there are already signals that less milk is being directed into Cheddar production. With UK farmgate prices continuing to rise in the first half of 2013/14, processors could see Cheddar margins eroded to a point where scaling back

production and/or diverting milk into other markets is either financially sensible or a financial necessity.

It is therefore possible that UK Cheddar production may be constrained until milk supplies increase, farmgate prices stabilise or UK wholesale prices move upward to a point where margins are attractive.