Weekly global protein digest: 2/3 of US dairy farms vanish, yet milk production rises by 1/3

Livestock analyst Jim Wyckoff reports on global protein newsWeekly USDA US beef, Pork export sales

Beef: Net sales of 17,700 MT for 2024 were up 32 percent from the previous week and 35 percent from the prior 4-week average. Increases were primarily for South Korea (5,300 MT, including decreases of 600 MT), Japan (3,500 MT, including decreases of 1,000 MT), Mexico (2,100 MT), China (2,100 MT, including decreases of 100 MT), and Canada (1,300 MT, including decreases of 100 MT). Exports of 16,200 MT were unchanged from the previous week and up 4 percent from the

prior 4-week average. The destinations were primarily to Japan (4,500 MT), South Korea (4,200 MT), China (2,300 MT), Mexico (1,300 MT), and Taiwan (1,200 MT).

Pork: Net sales of 31,500 MT for 2024 were up 5 percent from the previous week, but down 10 percent from the prior 4-week average. Increases were primarily for Mexico (12,800 MT, including decreases of 400 MT), Colombia (4,100 MT, including decreases of 400 MT), Canada (3,700 MT, including decreases of 800 MT), South Korea (2,600 MT, including decreases of 300 MT), and Japan (2,600 MT, including decreases of 200 MT). Exports of 30,100 MT were down 8 percent from the

previous week and 5 percent from the prior 4-week average. The destinations were primarily to Mexico (13,500 MT), Japan (3,900 MT), China (3,200 MT), South Korea (1,800 MT), and Colombia (1,800 MT).

USDA sees no need for mandatory testing for highly pathogenic avian influenza (HPAI) in dairy cattle.

- Voluntary efforts: USDA Undersecretary Eric Deeble stated that current voluntary measures are effective, making mandatory testing unnecessary.

- Federal order: The existing federal order requires testing of lactating dairy animals crossing state lines, but no "extraordinary emergency authority" is warranted.

- State measures: Colorado has implemented mandatory bulk testing due to a concentrated dairy industry in one county. Other states have testing requirements for dairy animals at events like fairs.

- CDC initiatives: The CDC announced a $10 million investment to address bird flu in farm workers. Half will be spent educating and training farm workers about how to avoid being infected. The other half will pay for seasonal flu vaccines for an estimated 200,000 farm workers who tend livestock and poultry. The CDC hopes to vaccinate all of them but acknowledges that less than half of the general population typically gets a flu shot.

- Human cases: There are 14 known human infections of highly pathogenic avian influenza that resulted from contact with infected dairy cattle and poultry in the United States, and all but one has happened in the past four months — nine are confirmed in Colorado among workers eradicating chickens at two poultry farms. The CDC considers the risk to the public low and has no pending human tests.

- Preventing mutations: Vaccinating farm workers against seasonal influenza aims to reduce the risk of new flu strains emerging.

- Milk production: HPAI has not significantly impacted US milk production on a national scale.

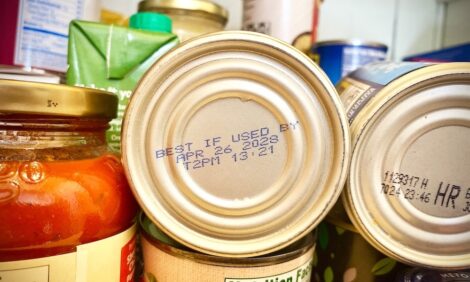

Boar's Head, a well-known deli meat company, is recalling additional 7 million pounds of product due to listeria outbreak

The recall is due to an outbreak of listeria, a dangerous bacterium, linked to two deaths and dozens of illnesses across 13 states. The recall involves various types of meats, such as liverwurst, ham, and salami, produced at their Virginia plant. The products have sell-by dates ranging from July 29 to Oct. 17. This new recall adds to an earlier one involving over 200,000 pounds of similar products. The issue was first detected when a liverwurst sample from Maryland tested positive for listeria. Subsequent tests confirmed the same listeria strain was causing illnesses. Consumers are advised to check their deli meat products and follow recall guidelines to prevent potential health risks.

USDA extends comment period on livestock competition rule

USDA's Agricultural Marketing Service (AMS) has extended the comment period for its proposed rule on Fair and Competitive Livestock and Poultry Markets by 15 days, moving the deadline to Sept. 11. Previously, comments were due by Aug. 27. The rule aims to define unfair practices as those that harm market participants and the market. The agency will publish a Federal Register notice to announce the extension.

USDA to unveil proposed rule declaring salmonella an adulterant

USDA's Food Safety and Inspection Service (FSIS) is set to propose a rule declaring salmonella an adulterant in raw chicken, chicken parts, ground chicken, and ground turkey products if present above specific levels. This follows a previous rule that declared salmonella an adulterant in breaded, stuffed raw chicken products. The proposed limit is 10 colony forming units (CFU) per gram, targeting three salmonella serotypes of public health significance. Once published in the Federal Register, there will be a 60-day comment period. The Office of Management and Budget (OMB) completed its review of the FSIS plan on July 26, paving the way for the announcement. It remains uncertain if the rule will be finalized before the end of the Biden administration.

Two-thirds of US dairy farms vanish, yet milk production rises by a third

California and Wisconsin continue to lead U.S. milk production, making up one-third of the total output, but the dairy industry has undergone significant changes over the past 20 years, according to USDA analysts. The number of dairy herds dropped from 70,375 in 2003 to 26,290 in 2023, while milk production increased from 170.3 billion pounds to 226.4 billion pounds, a 33% rise.

Texas and Idaho have grown to be among the top five dairy states, each contributing 7% to U.S. production. California’s production share decreased from 21% to 18%, and Wisconsin’s share rose to 14%.

Nationwide, there are fewer dairy cows, but they produce more milk. Large dairy farms with over 2,000 cows now provide 39% of the milk supply, with larger farms being more common in the West. These farms have become more specialized, focusing mainly on dairy production and relying more on purchased feeds. The Economic Research Service report highlighted that larger farms are also more likely to adopt advanced technologies and management practices.

China’s hog slaughter eases slightly in first half

China slaughtered 160.35 million head of hogs in the first half of the year, down 0.7% from the same period last year. China’s sow herd stood at 40.38 million head at the end of June, down 6.0% from last year.

Three more human cases of H5N1 in Colorado

The Colorado Dept. of Public Health and Environment reported three more bird flu cases among farm workers in Weld County, Colorado. The workers, who were culling birds with highly pathogenic avian influenza (HPAI) at an egg farm, are receiving antiviral treatment. This brings the total confirmed human cases of HPAI to 13 this year, with cases in Colorado, Michigan, and Texas. The cases include four workers from dairy farms and nine from poultry farms.

Study: Avian flu spreads from birds to cows and other mammals in US

A recent study published in Nature provides evidence of avian influenza (H5N1) spreading from birds to dairy cattle and subsequently from cattle to other mammals, including cats and a raccoon, across several U.S. states. This marks one of the first documented instances of efficient and sustained mammalian-to-mammalian transmission of this highly pathogenic virus, according to Diego Diel, associate professor of virology at Cornell University.

Whole genome sequencing of the virus did not show mutations enhancing its transmissibility in humans, though the occurrence of mammal-to-mammal transmission is concerning as it may adapt further. Thirteen human cases in the U.S. have been reported, primarily linked to cattle and poultry farms, including a recent outbreak in Colorado, suggesting the virus may have originated from dairy farms in the same county. The study involved extensive genomic sequencing and epidemiological modeling, revealing cow-to-cow transmission and spread to other mammals, likely through environmental contamination or direct consumption of raw milk from infected cows. The research was conducted by a team from Cornell University and Texas A&M Veterinary Medical Diagnostic Laboratory.

USDA projects the smallest rise in grocery prices for 2025 since 2018

Initial forecasts show a 2.0% increase in all food prices, a 0.7% rise in grocery prices, and a 3.0% hike in restaurant prices. For 2024, USDA maintains its prediction of a 2.2% increase in all food prices, with a 1.0% rise in grocery prices and a 4.3% increase in restaurant prices.

Details: Key grocery categories like fish, seafood, eggs, dairy products, and fresh fruits and vegetables are expected to see price drops in 2024 and further decreases in 2025. If realized, these forecasts would mark the smallest rises in food prices since 2019 for all food and since 2018 for grocery and restaurant prices.

Bottom line: USDA's projections indicate a continued moderation in food price inflation compared to recent years.

1481 Meats in Upham joins North Dakota State Meat Inspection Program

1481 Meats in Upham has become the newest North Dakota company to operate under the State Meat and Poultry Inspection Program, as confirmed by Agriculture Commissioner Doug Goehring. Owners Tyler and Kelani Welstad began custom exempt processing in September 2023 and officially started state-inspected operations on May 24, 2024. Their facility, named for its location at Highway 14 and 81st St. N., provides beef processing and sells retail jerky, sticks, and fresh meats. State-accredited meat processing plants can sell products wholesale within North Dakota, and after three months of official state operation, they can apply for the Cooperative Interstate Shipment Program to ship products nationwide. The NDDA meat inspection staff assisted the Welstads in meeting regulatory requirements, including a HACCP plan and SSOPs for plant sanitation. Currently, 19 North Dakota companies operate under the state program, with seven approved for interstate shipments, and 76 custom exempt facilities process private game and livestock.

Brazil is set to declare an end to the Newcastle disease outbreak in Rio Grande do Sul

That’s according to the Estadao newspaper, quoting Carlos Goulart, Secretary of Agricultural Defense. Goulart stated that technical data confirms the outbreak is over, and Brazil will notify the World Organization for Animal Health (WOAH) and share details with the international community. Following the first reported case since 2006, Brazil had imposed a voluntary export ban on poultry to certain countries. Normal export activities are expected to resume pending clearance from the affected countries. The agriculture ministry has not commented on the situation.

Background of the outbreak: The outbreak was first detected on a commercial poultry farm in the municipality of Anta Gorda, Rio Grande do Sul. The disease, which affects both domestic and wild birds, causes severe respiratory problems and can lead to death. The last confirmed cases in Brazil occurred in 2006 in subsistence birds in the states of Amazonas, Mato Grosso, and Rio Grande do Sul.

Impact on poultry exports: The outbreak led to significant disruptions in Brazil's poultry export sector. Brazil, the world's largest poultry exporter, voluntarily imposed an export ban on poultry products to certain countries, including China, Argentina, and Mexico. This precautionary measure was aimed at ensuring transparency and maintaining trust with international trading partners.

Weekly USDA dairy report

CME GROUP CASH MARKETS (7/26) BUTTER: Grade AA closed at $3.0900. The weekly average for Grade AA is $3.0845 (-0.0295). CHEESE: Barrels closed at $1.9700 and 40# blocks at $1.9300. The weekly average for barrels is $1.9600 (+0.0620) and blocks $1.9210 (+0.0580). NONFAT DRY MILK: Grade A closed at $1.2325. The weekly average for Grade A is $1.2230 (+0.0435). DRY WHEY: Extra grade dry whey closed at $0.5700. The weekly average for dry whey is $0.5410 (+0.0355).

BUTTER HIGHLIGHTS: Butter makers are running active production schedules in the East and Central regions, but churning is seasonally light in the West. Cream volumes are tight or tightening throughout the country. Contacts in the East region note spot volumes of cream are limited. In the Central region stakeholders say cream is more available than typical for this time of year, though butter makers are purchasing cream volumes from the West to meet their manufacturing needs. In the West, salted butter loads are available, while unsalted butter inventories remain tighter. Central region butter inventories are also available. Demand for butter is steady to lighter, domestically, in the Central and West regions this week, though contacts in the West relay moderate international interest. In the East, retail demand has held steady while food service sales are steady to lighter.

CHEESE HIGHLIGHTS: Cheese production schedules continue to trend steady to lighter throughout much of the U.S. Contacts in the East region relay mixed production schedules. Some processors are running production schedules in line with recent weeks, whereas others share lighter production. Contacts share retail demand remains strong. Cheesemakers in the Central region note active production schedules despite tightening spot milk availability. Spot milk prices were reported at Class III to $1.50-over. Cheese demand is steady, and some contacts shared increased interest from customers in Mexico. Contacts in the West indicate seasonally weaker cheese production. Spot milk availability is limited, but manufacturers have shared enough milk is available to meet production needs.

FLUID MILK: Nationwide, milk output is generally declining week to week due to warmer summer temperatures and normal seasonal milk production patterns. Some manufacturers indicate they had anticipated lower volumes for summer, and available milk volumes are accommodating production needs. Central region cheesemakers relayed spot prices are ranging from flat to $1.50-over Class. Class II and III milk demand is seasonally steady or strong, but Class I and IV processing is generally lighter due to lower milk production and demand. Moving milk for all classes is still challenging as cleanup from Hurricane Beryl continues across the Northeast. Stakeholders say condensed skim milk is moving steadily, but volumes have become less available as milk production has declined. Processors are finding a tighter market for condensed skim milk in all regions. Cream availability is tighter throughout the country, especially in the East and Midwest. Some loads of spot cream have made their way across the country from the West to butter makers in the Midwest. In some cases, when spot loads of cream become available in the East, they are being picked up around the 1.50 multiple mark. Cream multiples range from 1.30 – 1.50 in the East, 1.24 – 1.38 in the Midwest, and 1.16 – 1.39 in the West.

DRY PRODUCTS: Low/medium heat nonfat dry milk (NDM) prices were unchanged in the West, and Central and East regions this week. Production is seasonally lighter as condensed skim availability has tightened. High heat NDM prices held steady in the Central and East regions, but the price range expanded in the West. Dry buttermilk prices were unchanged in the Central and East regions, while the top of the West dry buttermilk price range dipped lower. Dry buttermilk production is trending lighter in all regions. Spot inventories are available, but not abundant. Dry whole milk prices were unchanged. Dry whey prices were unchanged in the West but moved higher in the Central and East regions. Processors continue to move whey solids into high percentage whey protein concentrates and whey protein isolate manufacturing streams. The top of the whey protein concentrate 34% price range inched higher this week. Production activity remains light, and inventories are overall tight. Lactose prices were unchanged this week. Inventories vary between manufacturers. Contacts shared increased demand from buyers in Mexico. Acid and rennet casein prices were unchanged this week.

ORGANIC DAIRY MARKET NEWS: The United States Secretary of Agriculture recently attended a group's organic field day event and spoke about the USDA's efforts in expanding access for producers to climate-smart agriculture. The Agriculture Secretary also highlighted the USDA's initiatives to expand the market for organic products through aiding producers in transitioning to organic production. A company which provides organic grass-fed dairy products recently announced they are expanding by adding farms located throughout Central Pennsylvania. A cooperative in the UK has established a milk pay price of 50 pounds per liter for the 2025/2026 season in an effort to recruit organic producers in the country and to recruit farmers interested in transitioning to organic production. The week 30 retail ad survey fewer organic dairy ads compared to the prior week. The most advertised organic dairy commodity remained yogurt, while milk remained the second most advertised organic dairy commodity.

NATIONAL RETAIL REPORT: Conventional dairy ads increased 8 percent, while organic dairy ads decreased by 15 percent this week. Conventional ice cream in 48-64 ounce containers was the most advertised dairy commodity. The weighted average advertised prices of 48-64 ounce containers and 14-16 ounce containers of conventional ice cream were $3.61 and $3.85, respectively. Shredded cheese in 6-8 ounce packages was the most advertised conventional cheese item, with a weighted average advertised price of $2.50, down from $2.81 the week prior. Organic milk in gallon containers had a weighted average advertised price of $6.98. The organic premium for a gallon container of milk was $3.55. Conventional gallon and half gallon containers of milk had weighted average advertised prices of $3.43 and $2.40, respectively.