Weekly global protein digest: Weekly USDA dairy report

Livestock analyst Jim Wyckoff reports on global protein newsWeekly USDA US beef, pork export sales

Beef: Net sales of 11,000 MT for 2024 were up noticeably from the previous week and up 32 percent from the prior 4-week average. Increases primarily for South Korea (3,400 MT, including decreases of 900 MT), Japan (3,400 MT, including decreases of 300 MT), Mexico (1,400 MT), Canada (800 MT), and China (700 MT, including decreases of 100 MT), were offset by reductions for the Philippines (100 MT) and El Salvador (100 MT). Net sales of 5,400 MT for 2025 were primarily for Japan (3,000 MT), South Korea (1,500 MT), the Philippines (200 MT), Taiwan (200 MT), and China (200 MT). Exports of 15,100 MT were up 5 percent from the previous week, but down 1 percent from the prior 4-week average. The destinations were primarily to South Korea (4,500 MT), Japan (2,900 MT), China (2,200 MT), Mexico (1,800 MT), and Taiwan (1,300 MT).

Pork: Net sales of 22,500 MT for 2024 were down 36 percent from the previous week and 1 percent from the prior 4-week average. Increases primarily for Mexico (9,100 MT, including decreases of 300 MT), Japan (4,500 MT, including decreases of 500 MT), China (2,700 MT, including decreases of 100 MT), Colombia (2,000 MT, including decreases of 100 MT), and South Korea (1,000 MT, including decreases of 600 MT), were offset by reductions for Australia (300 MT). Net sales of 4,600 MT for 2025 primarily for South Korea (2,400 MT), Japan (1,100 MT), Canada (500 MT), Mexico (300 MT), and Honduras (200 MT), were offset by reductions for China (500 MT). Exports of 33,800 MT were up 5 percent from the previous week and 10 percent from the prior 4-week average. The destinations were primarily to Mexico (14,700 MT), South Korea (3,900 MT), Japan (3,700 MT), China (3,100 MT), and Australia (2,000 MT).

Another HPAI outbreak in western Iowa poultry flock

The Iowa Department of Agriculture and USDA announced an outbreak of highly pathogenic avian influenza (HPAI) in a Sac County commercial turkey flock. This is Iowa’s seventh detection of HPAI in poultry this year and the fourth in less than a week.

China’s meat imports rise in November

China imported 581,000 MT of meat in November, up 46,000 MT (8.6%) from the previous month and 24,000 MT (4.3%) more than last year. Through the first 11 months of this year, China imported 6.06 MMT of meat, down 11.2% from the same period last year.

China resumes British pork imports

Major British pork produces can resume shipments to China, the UK ag ministry announced. China is the UK’s largest non-EU pork customer.

McDonald’s fights back after E. coli outbreak with $100 million recovery plan

McDonald’s is taking decisive steps to recover from an E. coli outbreak that affected over 100 people and prompted the temporary removal of its popular Quarter Pounder in October. The fast-food giant announced a $100 million campaign to win back customers, with one-third of the budget dedicated to advertising and marketing. “We’re working through testing... different messages, different offers, different deals,” said Joe Erlinger, McDonald’s U.S. president, emphasizing efforts to re-engage app-loyalty diners who have stayed away since the outbreak.

While US health officials declared the outbreak over, McDonald’s faces lingering challenges. Rising inflation has pressured the chain to pivot from its $1 menu to a broader value strategy, including new offers like the $5 bundle and app-exclusive deals. “We want to be a destination for value,” Erlinger noted, acknowledging consumer frustrations with inflation: “You’re going to have this vision of what you paid back in 2019 that you’re never going to pay again.”

Bottom line: Despite setbacks, the chain continues its push for innovation and pricing strategies, aiming to regain momentum and customer trust.

Dairy, veg oils push FAO food price index higher

The UN Food and Agriculture Organization global food price index rose 0.5% in November, driven by higher prices for dairy products and veg oils, which slightly outweighed declines in meats, cereal grains and sugar. The November index increased 5.7% from last year to the highest level since April 2023. Compared to year-ago, prices rose 5.8% for meat, 20.1% for dairy and 32.2% for veg oils, while values fell 7.9% for cereal grains and 21.7% for sugar.

California bans "sell by" dates to cut food waste and save people money

California’s new food labeling law, set to take effect in 2026, bans confusing “Sell by” dates in favor of clearer labels like “Best if used by” (for quality) and “Use by” (for safety). Aimed at reducing the 6 million tons of food waste Californians generate annually, the law hopes to empower consumers with consistent labeling while benefiting the environment and saving money. Critics acknowledge implementation challenges but praise the effort to reduce confusion and curb waste. Experts recommend relying on sensory checks for spoilage and tools like the USDA FoodKeeper app for guidance.

Weekly USDA dairy report

CME GROUP CASH MARKETS (12/6) BUTTER: Grade AA closed at $2.5450. The weekly average for Grade AA is $2.5285 (+0.0318). CHEESE: Barrels closed at $1.6900 and 40# blocks at $1.7000. The weekly average for barrels is $1.6510 (+0.0227) and blocks $1.6745 (-0.0030). NONFAT DRY MILK: Grade A closed at $1.3900. The weekly average for Grade A is $1.3825 (-0.0042). DRY WHEY: Extra grade dry whey closed at $0.7100. The weekly average for dry whey is $0.7135 (+0.0268).

BUTTER HIGHLIGHTS: Butter demand following the holiday week is mixed. Some stakeholders indicate many end-users have Q4 inventory needs secured. However, some retailers convey willingness to take in more inventory at current market prices. Although cream volumes are comparatively tighter in the southwest part of the country, cream loads are generally widely available throughout the nation. Butter production paces are mixed for the post-holiday week. Weather related power losses at butter churning facilities, churn equipment projects, and holidays have made impacts on production schedules recently. Bulk butter overages range from minus 2 to 6 cents above market, across all regions.

CHEESE HIGHLIGHTS: Cheese production schedules vary from steady to stronger throughout the U.S. In the East region, milk volumes remain tight. Cheese plant managers relay bringing spot milk volumes in from other regions to keep cheese manufacturing steady. Contacts share retail demand is steady, while food service demand remains mixed. Cheesemakers in the Central region relay active production schedules. Contacts share milk availability varies in different pockets of the region, with spot milk prices ranging from flat to $1 above Class III. Cheese plant managers share demand is mixed. Italian style and cheddar cheesemakers share demand ranges from steady to stronger. Cheese production is mixed in the West region. Spot milk availability is tighter in some areas of the region. Contacts share cheese inventories are readily available for interested spot purchasers.

FLUID MILK HIGHLIGHTS: Milk production is generally noted as steady or stronger throughout the country. However, recent week-to week California milk production differences are mixed. Some California milk handlers convey November 2024 milk output was down compared to the prior month. That said, both protein and milkfat components in milk output continue to be strong across the nation. Spot milk load availability is tighter in the southwest part of the country compared to the rest of the nation. Midwest spot milk prices were reported from Class to $1-over Class III. Class I, II, and III demands vary from strong to steady. Class IV demand is steady. Condensed skim milk availability and demand are both mixed. Midwest cream suppliers relayed some pickup in ice cream manufacturing. Cream multiples for all Classes are 1.17-1.28 in the East, 1.08-1.28 in the Midwest, and 1.00-1.32 in the West.

DRY PRODUCTS HIGHLIGHTS: Low/medium heat nonfat dry milk (NDM) prices were mixed. In the Central and East regions, prices were steady to higher, while Western prices dipped lower. Demand notes vary from quiet to steady. Dry buttermilk prices moved higher throughout the country. Butter churning rates are strong, but drying schedules are mixed. Dry whole milk prices slid lower this week on quiet domestic demand. Dry whey prices moved higher throughout the nation this week. Demand is strong, and availability is notably limited. Whey protein concentrate 34% prices remain in rarified bullish air, as the upward price trend continues. Lactose prices were steady to lower, despite strong domestic demand notes. Rennet and acid casein prices were unchanged as traders work through Q1 2025 contractual negotiations.

INTERNATIONAL DAIRY MARKET NEWS:

WEST EUROPE: The most recent European Commission Latest World Quotations of Dairy products listed butter prices for the week ending 11/24/24 were 44 percent above the same week last year. Skim milk powder prices were listed at 3 percent below the same week last year. Whole milk powder prices were listed at 13 percent above the same week last year.

EAST EUROPE: Before a government meeting on Tuesday, the Polish Prime Minister announced the country's opposition to the EU-Mercosur free trade deal in its current form. Polish officials announced the country's first confirmed cases of bluetongue disease. The cases were recorded in beef cattle on a farm in southwestern Poland.

AUSTRALIA: According to Dairy Australia, October 2024 milk production, 917.7 million liters, was up 1.3 percent from October 2023. October 2024 milk production was up from the prior year in New South Wales, Victoria, and South Australia. Meanwhile, milk production was down in Queensland, Western Australia, and Tasmania. Milk production from the start of the season in July 2024 through October 2024, 2,991.1 million liters, increased 1.7 percent compared to the same time frame a year earlier.

NEW ZEALAND: Export data for October 2024 was recently released for New Zealand. This data showed a 16 percent increase in value for milk powder, butter, and cheese exported in October 2024 compared to October 2023. Fresh milk and cream export values were 14 percent higher in October 2024, when compared to a year earlier. Changes in export quantities from October 2023 to October 2024 for milk powders, milk fats (including butter) and cheese are + 3.8 percent, - 3.5 percent, and + 7 percent, respectively. Infant formula export values in October 2024 were 7 percent higher compared to a year prior, while casein and caseinate values were down 20 percent.

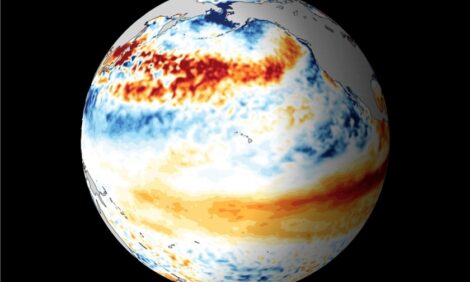

SOUTH AMERICA: Timely climactic improvements have prompted a rise in feed availability and cow comfort levels in key areas of the South American region, but there is one notable holdout. Brazilian milk output, although slowly ticking seasonally higher, is still reeling from a notably hindered onset of the spring milking season. Reports suggest areas of Brazil still have time to "catch up" over the next two months if conditions continue to improve.

NATIONAL RETAIL REPORT: Total conventional dairy advertisement numbers shifted 12 percent lower from Thanksgiving week, while organic dairy ad totals increased by 15 percent. Regarding total organic commodities, most ad totals moved up, but organic sour cream ads jumped by nearly 1,000 percent during week 49. Conventional ice cream, in 48-to-64-ounce containers, was the most advertised item again this week. Half-gallon milk ads were the most advertised single organic item this week.