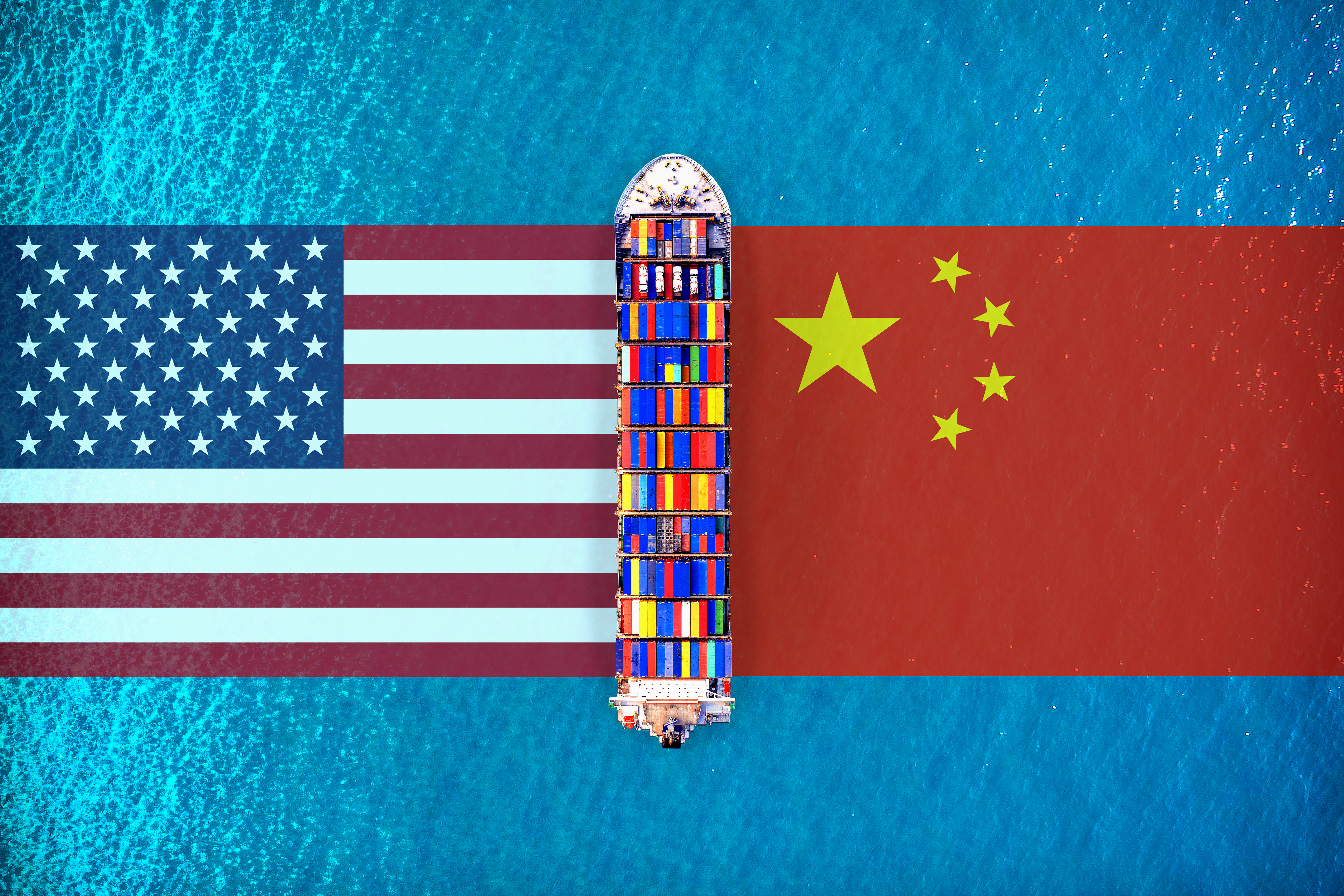

Weekly beef and dairy digest: US takes a firmer stance on China

In this week's beef and dairy digest, Jim Wyckoff walks us through the latest USDA data on the cattle industry.US tone on China continues aggressive

Secretary of State Antony Blinken declared that China has been acting “more aggressively abroad” and has taken on an “adversarial” tone, according to his remarks on CBS 60 Minutes broadcast that aired Sunday.

Asked if the US and China were headed for a confrontation, Blinken said, "It's profoundly against the interests of both China and the United States to, to get to that point, or even to head in that direction." But he reiterated China’s actions over the past few years have been much more aggressive. "What we've witnessed over the last several years is China acting more repressively at home and more aggressively abroad. That is a fact,” Blinken stated.

He also pointed to the US push to round other countries to take on China, saying the administration’s message has been “bringing like-minded and similarly aggrieved countries together to say to Beijing: 'This can't stand and it won't stand.'" However, Blinken also said the US is not trying to “contain China” in its focus on the country.

US beef shipments decline

US beef: net sales of 16,900 metric tonnes (MT) reported for 2021 were down 28% from the previous week and 18% from the prior four-week average. Increases were primarily for Japan (4,600 MT, including decreases of 500 MT), Mexico (3,000 MT, including decreases of 100 MT), Taiwan (2,900 MT, including decreases of 100 MT), South Korea (2,300 MT, including decreases of 500 MT), and Canada (2,100 MT, including decreases of 100 MT).

For 2022, total net sales of 200 MT were for Canada. Exports of 18,500 MT were down 1% from the previous week and 3% from the prior four-week average. The destinations were primarily to Japan (5,300 MT), South Korea (5,100 MT), China (3,200 MT), Mexico (1,500 MT), and Taiwan (900 MT).

Export opportunities for Brazilian beef producers

Although the COVID-19 pandemic continues to affect Brazil and its economy, the Brazilian market presents niche opportunities in the high-end beef market. Brazilian imports of premium beef grew by 26.3% last year compared to 2019.

Although Brazil is the second-largest beef producer in the world, these figures reveal potential market opportunities. The leading exporters of this type of product to Brazil are Paraguay, Argentina, Uruguay, Australia, and the United States. Brazilian ranchers are keeping an eye on their domestic premium market and will inevitably participate and compete with these countries at some point. However, they still must adapt local production to achieve the quality required by this demanding market.

US milk production, disposition, and income 2020 summary

USDA reports US milk production increased 2.2% in 2020 to 223 billion pounds. The rate per cow, at 23,777 pounds, was 382 pounds above 2019. The annual average number of milk cows on farms was 9.39 million head, up 51,000 head from 2019.

Cash receipts from marketings of milk during 2020 totaled $40.5 billion, up slightly from 2019. Producer returns averaged $18.25 per hundredweight, 2.1% below 2019. Marketings totaled 222.1 billion pounds, 2.2% above 2019. Marketings include whole milk sold to plants and dealers and milk sold directly to consumers. An estimated 1.09 billion pounds of milk were used on farms where produced, 6.2% more than 2019. Calves were fed 92% of this milk, with the remainder consumed in producer households.

USDA weekly US milk report

Fluid milk

US milk production varied across the regions in the latest reporting week, with high output reported in the Southeast, Midwest, and generally throughout the West. Production is steady in the Northeast. Output is in a slow decline in Florida. Regardless, there is plenty of milk available across the country for processing operations.

Class I demand is steady to higher nationwide, however some Midwestern contacts have reported a concern with limited bottling demand in the near future. Contacts report that condensed skim discounts are scarce to non-existent. Tanker delays related to driver shortages are a growing problem throughout all regions. Cream multiples are generally similar to last week, despite reports of a slightly tightening availability.

Dry products

Across all regions low/medium and high heat non-fat dry milk (NDM) prices increased this week. Global demand is putting a strain on domestic production/supply. Dry buttermilk prices shifted higher at the bottom of the range in the Central and East, while prices in the West also moved up at the bottom of the range and both sides of the mostly price series. Domestic demand for dry buttermilk has lessened in recent weeks, but international demand remains strong. The gap between international and domestic dry whole milk prices is closing as domestic prices continue to increase. National dry whey prices are steady to higher.

Demand has slowed as higher prices have made purchasers hesitant. WPC 34% prices are steady to higher. Supplies are short for WPC 34% that is needed for specific purposes, particularly infant formula manufacturing. Lactose prices are steady as production is keeping pace with demand. Contacts are concerned that potential impediments, such as African swine fever or freight/port constraints, could abruptly shift currently healthy market prices. Acid and rennet casein prices held steady on the shortened week.

TheCattleSite News Desk

IMPORTANT NOTE: I am not a futures broker and do not manage any trading accounts other than my own personal account. It is my goal to point out to you potential trading opportunities. However, it is up to you to: (1) decide when and if you want to initiate any traders and (2) determine the size of any trades you may initiate. Any trades I discuss are hypothetical in nature.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading (and I agree 100%): 1. Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND RISKY BUSINESS. Before you invest any money in futures or options contracts, you should consider your financial experience, goals and financial resources, and know how much you can afford to lose above and beyond your initial payment to a broker. You should understand commodity futures and options contracts and your obligations in entering into those contracts. You should understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk disclosure documents your broker is required to give you.