Weekly dairy digest: USDA releases its annual dairy market and trade report

The USDA predicts strong performance for the global dairy sector as China's import demand soars.USDA’s annual dairy market and trade report

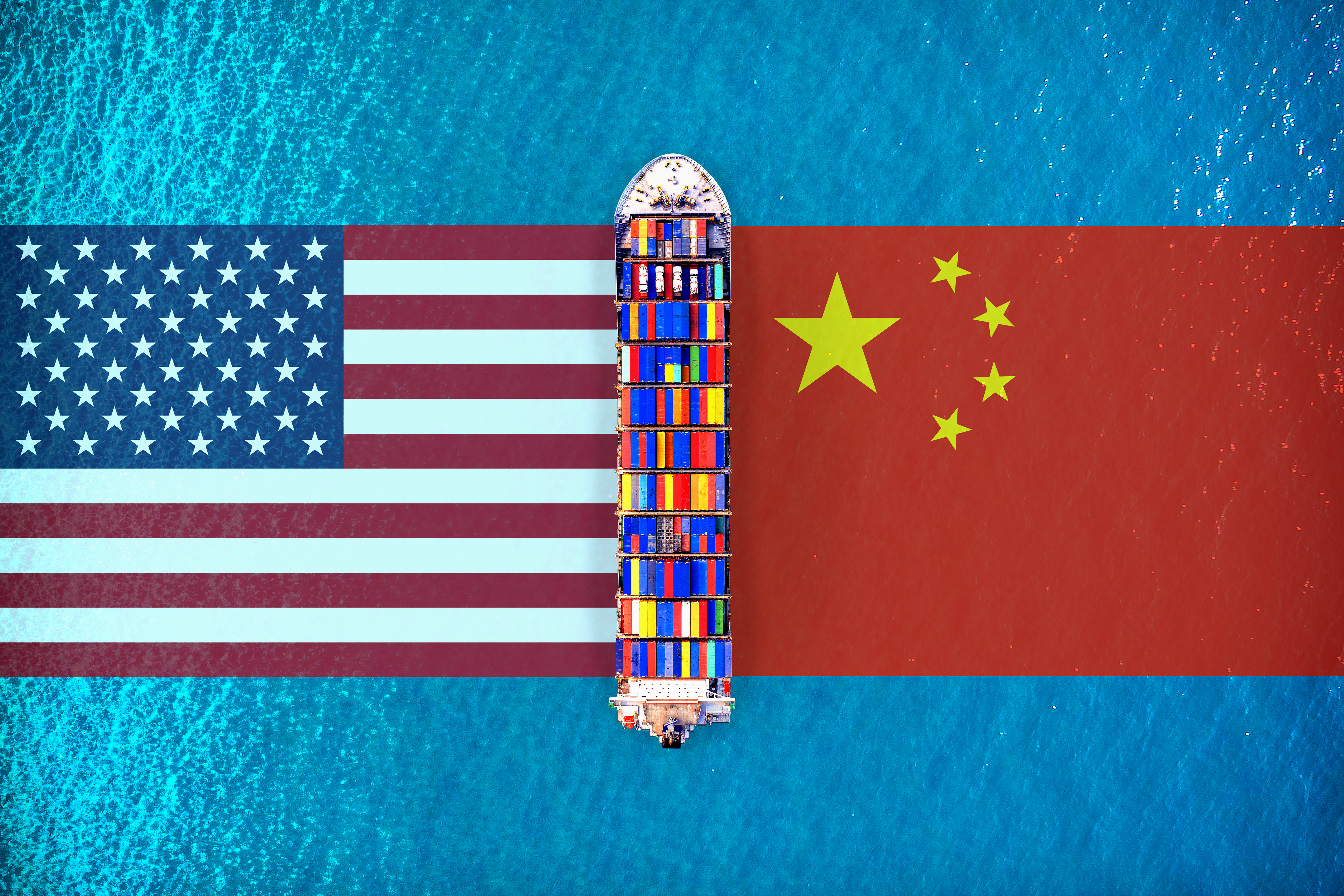

USDA in its annual dairy report said global dairy prices are relatively strong due in large part to the unprecedented import demand for dairy products by China. This year, in the period from January through May, China’s imports of dairy products have grown by nearly 17% to reach $6.4 billion. There has been a surge in China’s import demand for a broad range of dairy products, notably fluid milk, milk powders, and whey and whey products.

Perhaps most surprising has been the recent surge in imports of skimmed milk powder (SMP) which have departed from the traditional pattern of purchases. In the past, inflows of SMP were more pronounced in the first quarter due to the free trade agreements (FTAs) with New Zealand and Australia. Thereafter, they stabilized at around 20,000-30,000 tonnes per month for the balance of the year. This year, SMP imports are on a new trajectory having steadily climbed since February and are now up 50 percent through May in comparison to last year. China’s imports of SMP are now forecast to reach a record 480,000 tonnes.

Although US dairy exporters have only captured a small portion of the China dairy import market that is dominated by the EU-28 and Oceania, it remains a critical market. It is currently ranked as the second-largest market on a volume basis for US dairy exports after Mexico. This year, the volume of US dairy exports to China through May is already up nearly 75% year-over-year. Shipments of US SMP through this period are up nearly fivefold. But US dairy exporters are also indirectly benefitting from China’s import demand as a result of the higher global dairy prices. They have also been able to take the opportunity to ship greater quantities of dairy products to relatively new markets such as Vietnam.

Milk output in the European Union-28 was slow to start the year but improved into the spring months. Through May, output is running marginally below 2020 (-0.3%). Cold weather initially dampened milk deliveries in January and February, which were 1% and 4% below a year ago, respectively. Thereafter, conditions began to improve with mid-spring rainfall supporting pasture growth in critical milk production months.

In May, the month with the largest milk production, deliveries were nearly 2% stronger than in 2020. Foreign Agricultural Service/USDA 3 July 2021 Global Market Analysis Recent year-over-year growth in milk output is expected to continue as strong Chinese demand supports dairy product prices, offering some cushion against higher feed prices. European Union milk production is expected at 158.5 million tonnes, about 1% higher than 2020. Better herd management, including high-quality genetics, is expected to cause continued growth in output per cow, offsetting a smaller herd size.

The Australia milk production forecast is revised down 2% to 9.2 million tonnes due to the unanticipated exit of dairy farmers switching to beef cattle production. Initially, the number of cows was expected to grow by 1%, but with the revised forecast the dairy herd is now expected to decline by 1% from 2020.

Currently, milk output for this year through May is up nearly 1% over the comparable period in 2020 due to good pasture conditions, ample fodder and grain supplies, and strong milk prices. Most of the key dairy regions have received average to above-average rainfall so far this year and farm gate milk prices for the 2020/21 season are currently expected to surpass the average milk price of the past five years. While these strong prices would normally be expected to boost output, expansion has been constrained by the aforementioned shift to beef production, high dairy farm prices, and labor shortages.

The New Zealand milk production forecast for this year is revised up to 22.4 million tonnes – an increase of 1% over the record setting level in 2020. Despite a forecast decline in the milk herd, this is expected to be offset by a 3% rise in yield per cow. Milk output for the year through May is up 6% year-over-year, but the key production season is during the August to December period when approximately 60% of the annual milk supply is produced.

Cows are currently in good condition and have benefitted from plentiful supplies of feed. Further, the price outlook is bright as Fonterra announced an initial milk pay-out mid-point price of a record NZ $8 (US $5.60) per kg of milk solids for the 2021-22 season. This represents 6% increase over the 2020/21 pay-out. For the July-September 2021 period, the National Institute of Water and Atmospheric Research (NIWA) in New Zealand is forecasting normal to above-normal rainfall.

However, NIWA warns that New Zealand’s weather patterns are expected to vary substantially week-to-week over the coming months since currently neither the El Niño nor La Niña weather patterns are currently prevailing.

USDA’s weekly dairy retail report

Conventional ice cream in 48 to 64-ounce containers holds the title for most advertised dairy item this week, by a wide margin. The national weighted advertised average price is $2.83, up $0.04 from last week.

The national weighted average advertised price for conventional 1-pound butter is $3.47, down $0.11 from last week. The national weighted average advertised price for organic 1-pound butter is $4.99, down $0.51 from last week.

Total conventional dairy advertisements are up 10%, while total organic dairy ads decreased 15% from week 27.

July supply and demand estimates

Milk production forecast for 2021 is lowered from last month as slower-expected growth in milk per cow more than offsets higher forecast cow numbers. However, the 2022 milk production forecast is raised from last month on higher cow numbers.

Imports on both fat and skim-solids bases are raised for 2021 and 2022 on stronger expected imports of cheese and butterfat containing products. Exports on a skim-solids basis are also raised for 2021 and 2022, reflecting stronger exports of whey, skim/non-fat dry milk powder, and lactose. Fat basis exports are unchanged from last month.

For 2021, cheese, butter, non-fat dry milk (NDM), and whey price forecasts are lowered from last month on relatively high stocks and weaker-than-previously-expected demand. As a result, Class III and Class IV prices are lowered. The 2021 all milk price forecast is lowered to $18.30 per cwt.

TheCattleSite News Desk

IMPORTANT NOTE: I am not a futures broker and do not manage any trading accounts other than my own personal account. It is my goal to point out to you potential trading opportunities. However, it is up to you to: (1) decide when and if you want to initiate any traders and (2) determine the size of any trades you may initiate. Any trades I discuss are hypothetical in nature.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading (and I agree 100%): 1. Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND RISKY BUSINESS. Before you invest any money in futures or options contracts, you should consider your financial experience, goals and financial resources, and know how much you can afford to lose above and beyond your initial payment to a broker. You should understand commodity futures and options contracts and your obligations in entering into those contracts. You should understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk disclosure documents your broker is required to give you.