AHDB: quarterly UK dairy market update

The UK dairy industry has faced rapid change through 2021 as it adjusts to a new trade relationship with the EU and the impacts of the pandemic on consumption patterns, writes Patty Clayton with AHDB.Rising costs have also been a key feature of the year, with higher feed costs impacting on milk production and more recent spikes in energy costs influencing the whole supply chain.

The question remains on how farmgate milk prices will develop given the pressures on margins through the supply chain.

Milk production

Minimal growth in domestic milk supplies is expected for the remainder of 2021. Based on the latest forecast, total deliveries in the UK for 2021 are expected to reach just over 15bn litres, only 80m litres more than deliveries in 2020.

To date (Jan-Sep), UK farmers have delivered 11.4bn litres of this, meaning we would expect around 3.6bn litres to be delivered in the final 3 months of the year, marginally less than deliveries in the final quarter in 2020.

Weighing on production levels in the UK, are rising costs of the ‘big three’ - feed, fertiliser and fuel – and the impact of this on margins. While milk prices have been generally rising through the past 12 months to average between 28-30ppl, they are increasingly being eroded by input cost inflation.

Product availability

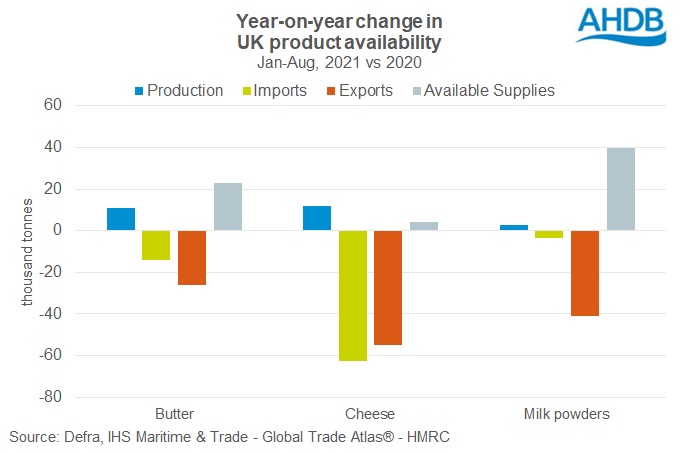

The relatively limited growth in milk deliveries, combined with the gradual return of out-of-home demand, has meant product availability for most products on the UK market has tightened.

This, along with concerns of winter production and the potential for some manufacturers to hold some stocks due to issues with transport, has seen dairy product prices remain firm in recent months.

While imports can help alleviate some of the pressure of tight domestic availability, this is unlikely to offer much relief. EU product pricing is currently at a premium to domestic markets for most products[1] as milk deliveries are not sufficient to improve low stock levels. Adding high transport costs into the mix further limits the ability of imports to take the pressure off rising prices.

Farmgate prices

Taken as a whole, the rising market returns would normally point towards increases in market-related farmgate milk prices. However, the trend in rising input costs is impacting the whole supply chain and could limit the benefit of rising wholesale prices on processor margins.

We would normally expect farmgate milk prices to move in line with market returns[2] after a period of time to allow for negotiating prices within contracts. However, processors are also facing rising costs across a range of inputs. The spiralling energy costs will be particularly challenging for some companies depending on their product mix and exposure to recent price hikes, as highlighted in the recent report from Kite Consulting. This will have an impact on the net value they will be able to recover from the market, and could limit their ability to increase milk prices if they can’t increase selling prices to their customers.

AHDB last reviewed the cost figures used in our market indicators (AMPE/MCVE) in July 2021, using the latest cost data from Office for National Statistics (ONS), covering quarter 1 2021. At that time, it was found the net impact of rising costs was minimal, reducing the indicators by 0.3ppl. Since then, energy prices have seen more significant increases, which will be reflected in the cost indexes from quarter three.

AHDB will next be reviewing the cost elements of the indicators upon publication of the ONS data for quarter three of this year in December, and will carry out quarterly reviews while input costs continue to move quickly.

TheCattleSite News Desk